The Wisconsin Center for Manufacturing and Productivity (WCMP) recently released their 2024 Wisconsin Manufacturing Report. Ascedia’s Director of New Business Development, Pat McGovern, had the opportunity to attend a presentation of the report. Here are his key takeaways for manufacturers in Wisconsin.

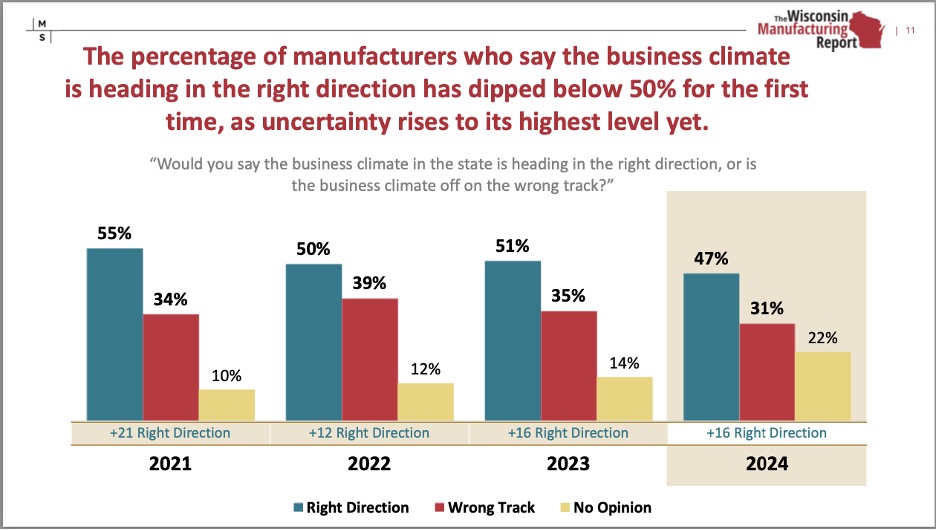

#1 Business climate is NOT heading in the right direction

The first chart below doesn’t paint a good picture for many in the manufacturing space. Since 2021 there has been an eight-point drop in those believing the business climate is moving in the right direction.That is significant.

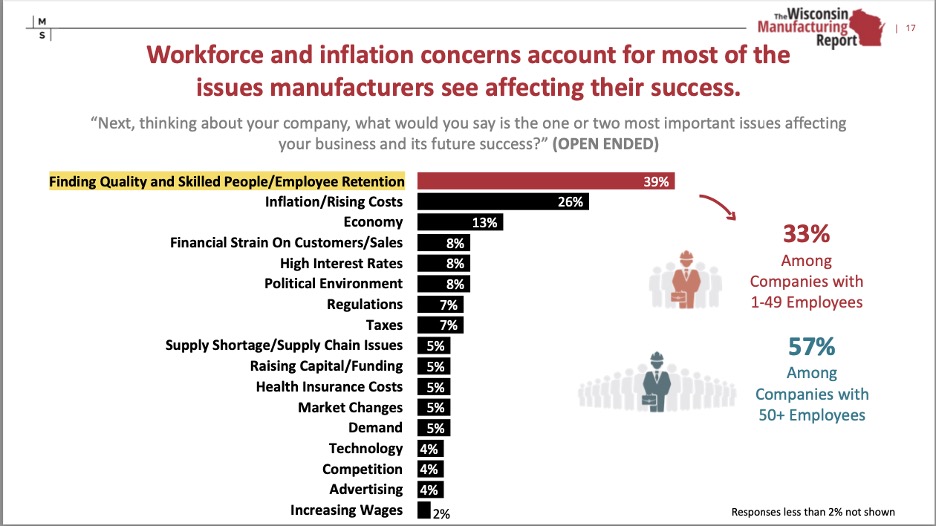

What’s causing the drop? The chart below provides some indication. As you can see, the two biggest areas of concern are the workforce and inflation.

Neither should be a surprise. And I’ll go deeper into the workforce issue next.

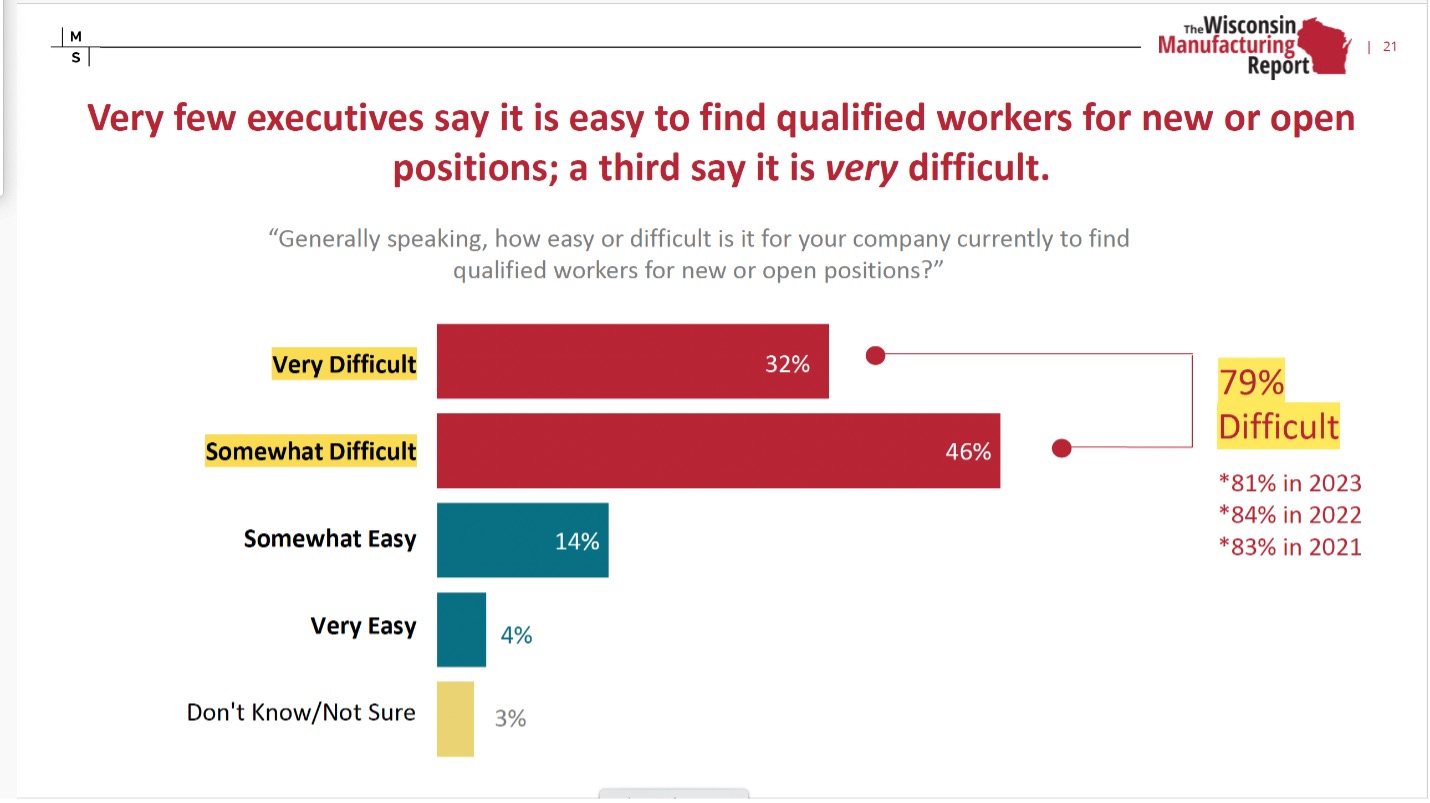

#2 The workforce challenge

Talk to anyone in the manufacturing space and they all have the same issue: finding and retaining workers. It has been a challenge for years and this issue will continue into the future. Consider the chart below.Nearly 80% of those surveyed find it difficult to find “qualified” workers.

This will continue to be an issue until there is a fundamental change in the options we provide for our children.

What do I mean by that?

The current narrative in this country is this: graduate high school and the next move in your future is to attend a four-year college.

But for many that not the right move

Throughout the U.S. we have walked away careers in manufacturing. Until that prevailing attitude changes, organizations will need to get creative in how they find workers.

SIDE NOTE: During the presentation, Buckley Brinkman, CEO at WCMP had an interesting observation. He told the group that the organizations having the most success finding and retaining employees were those getting creative in their approach.

They weren’t JUST focused on salary and benefits. While it was a part of the conversation, often potential employees were more interested in other factors such as flexible working hours so they could take care of children or aging parents as well as education and ongoing training and potential career paths.

If organizations want workers – they will need to consider the individual and his or her life situation when it comes to making an offer.

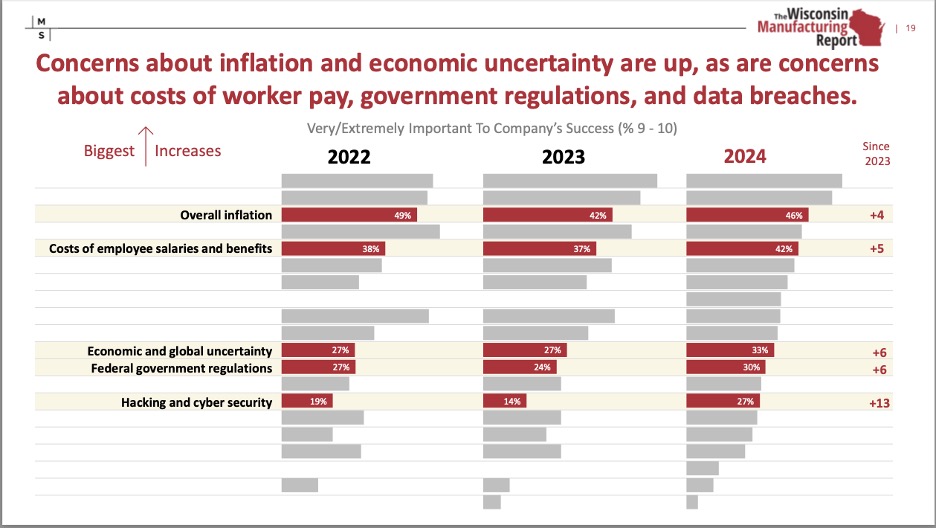

#3 Cybersecurity

The next chart deals with those issues that saw the biggest increases from 2023. I’ve already touched on inflation and the workforce, so let me turn your attention to the bottom of the chart.Hacking and cybersecurity have shot through the roof – moving up 13 points year over year!

And my guess is this will continue to grow in the coming years.

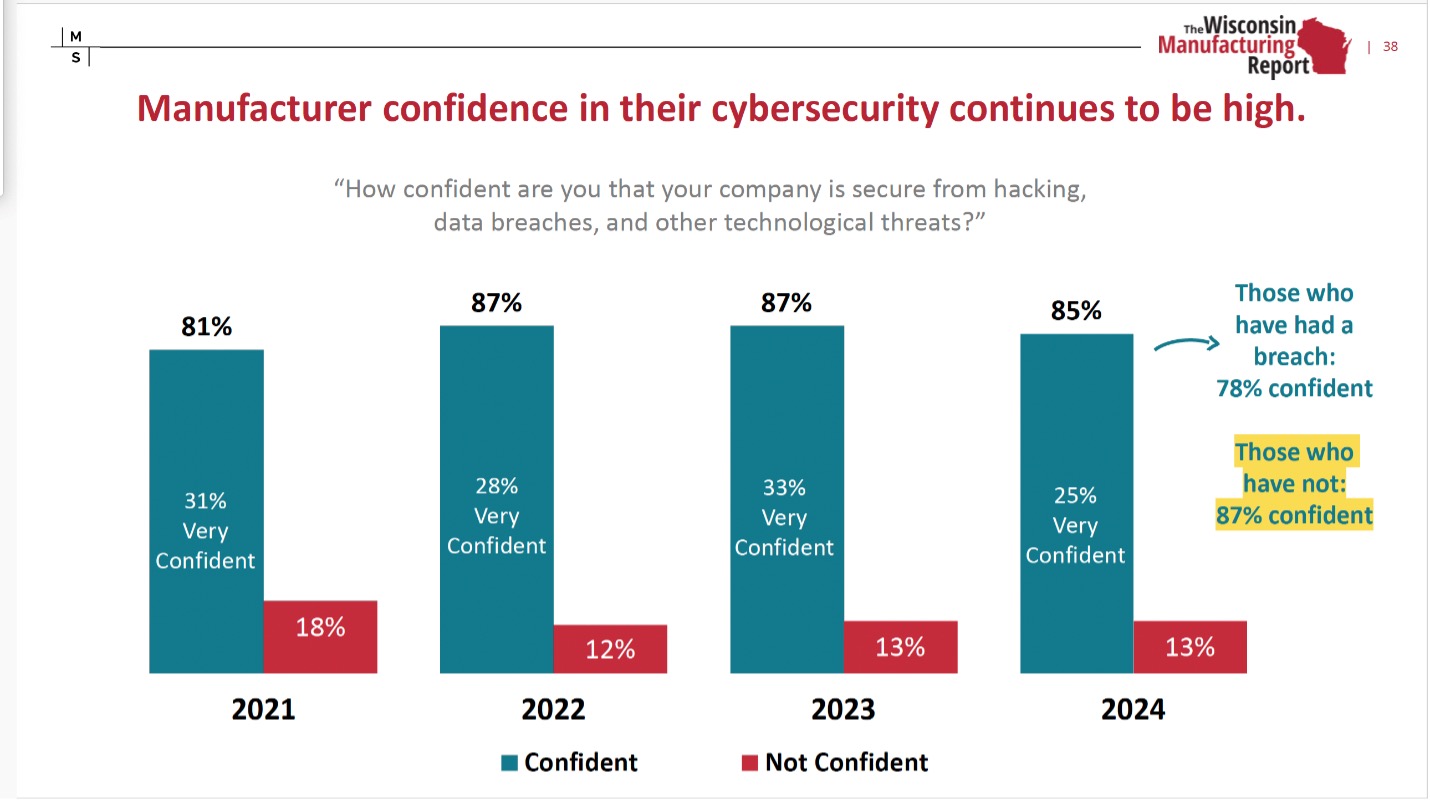

Sticking on the cybersecurity topic for another minute, take a look at the next chart.

Since 2021 80+ percent surveyed indicated they are confident to very confident they are secure from breaches.

My gut is telling me that while manufacturers believe they are secure – they may not be as protected as they think.

#4 The rise of AI

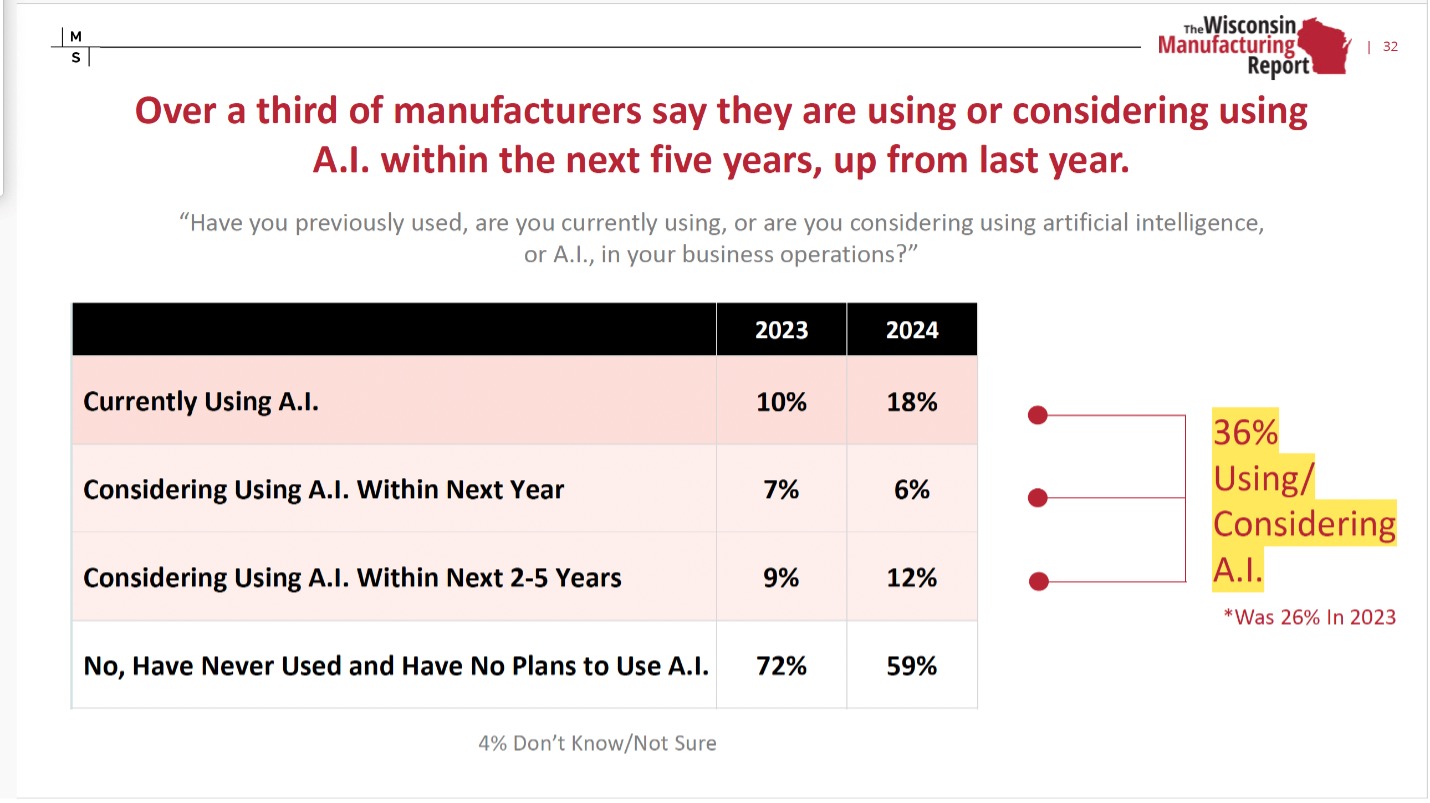

The fourth point that stood out was the rate of AI adoption with the sector. Look at the following chart.

AI is growing, with roughly one third indicating they are using or considering using AI. To give you a sense as to how this stacks up, I did a quick Google search and found this from Exploding Topics:

"77% of companies are either using or exploring the use of AI in their businesses, and 83% of companies claim AI is a top priority in their business plans."

So, by comparison, Wisconsin manufacturers are lagging.

What blows me away is the number that haven’t used it and have no plans to use AI. That’s nearly 60%!!

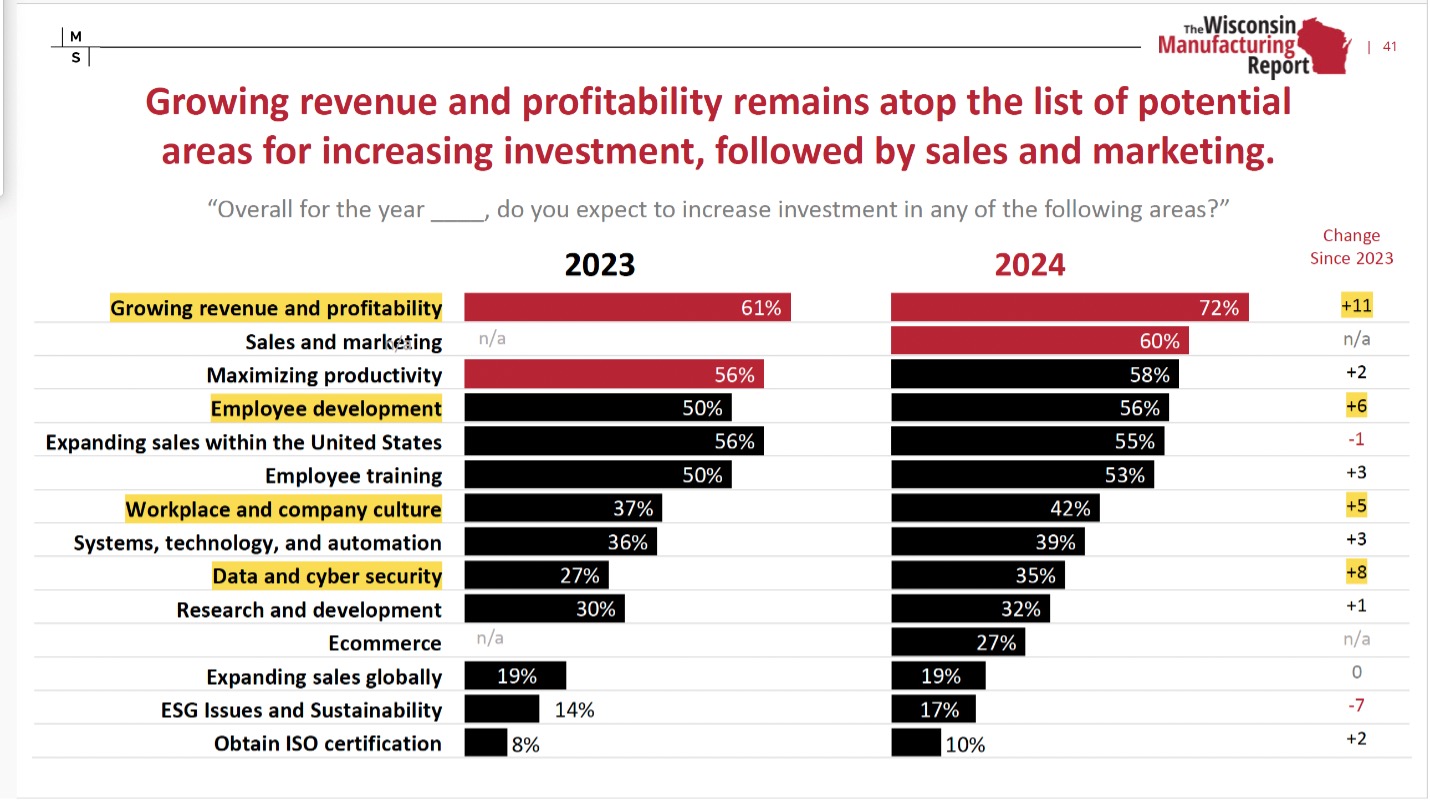

#5 Investment into the future

The final takeaway--where manufacturers will be investing in the future.

The first chart (above) indicates for the remainder of ’24 and into ’25, investment will center on growing revenue and profitability.

This year also was the first year the study tracked potential investment into sales and marketing. Notice that is the number two answer.

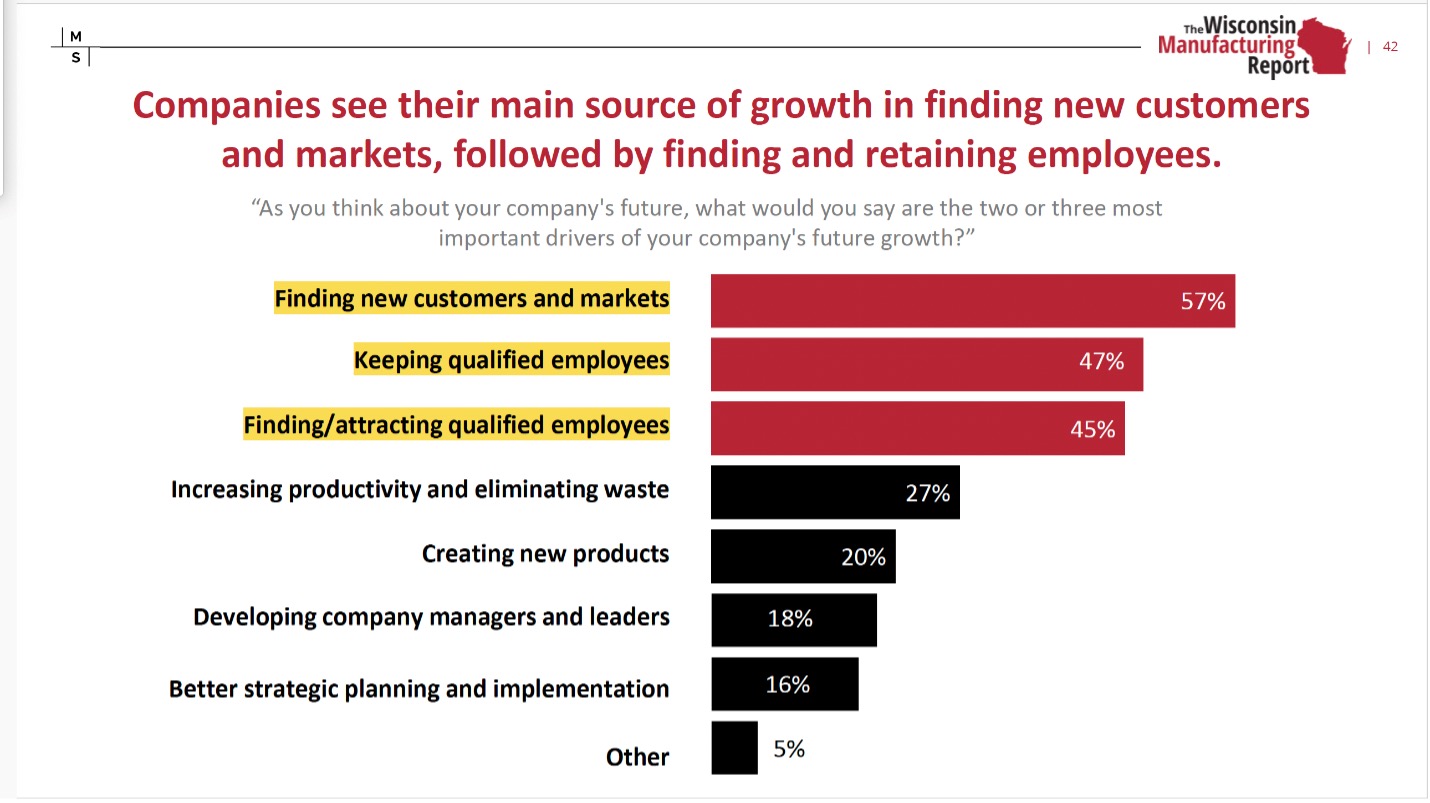

And how are manufacturing companies going to grow revenue and profitability. The chart below provides the answer.

Manufacturers must find more customers – but to serve those customers they need to hold on to their workers.

Key Takeaways

It’s clear – the future of manufacturing in Wisconsin rests with companies’ ability to find, grow, and retain talent. It’s a foundational issue. Automation can and will help but the fact is automation typically takes longer to be fully implemented and for the results to be seen.For the here and now – workers are needed. To get them, companies will need to be creative and customize their job offers by the individual.

Those companies that have been doing this have been seeing success.

.jpg?ext=.jpg?width=760&height=540&rmode-crop&format=webp&quality=90)